3 Ways the Fed Decision Could Move Markets.The Fed’s Major Interest Rate Decision: What to Expect

The Federal Reserve is set to make a significant decision this Wednesday regarding interest rates. This meeting is different from previous ones. There’s a sense of uncertainty surrounding what the Fed will do next.3 Ways the Fed Decision Could Move Markets

A Shift in Expectations

Typically, Fed meetings follow a predictable pattern. Policymakers usually signal their intentions well in advance. Markets react accordingly, and everyone has a general idea of the outcome. However, this time, expectations are mixed. Many believe the Fed will cut rates, but the extent of the cut remains a point of contention.

The Rate Cut Debate

Will the Fed opt for a traditional quarter-point reduction? Or will they take a bold step and reduce rates by half a point? This debate creates an unusual atmosphere for this meeting. Traders had largely anticipated a 25-basis-point cut. Recently, though, sentiment shifted. A half-point cut is now being considered, reflecting changing market dynamics.

Mark Zandi, chief economist at Moody’s Analytics, shared his thoughts. Thus, he argues, it’s time to normalize rates quickly.

Market Reactions

Market pricing has been volatile leading up to the meeting. Until late last week, traders leaned towards a 25-basis-point cut. Suddenly, on Friday, the mood changed. By Wednesday afternoon, there was a 63% chance of a larger cut. This uncertainty reflects the cautious approach many on Wall Street are taking.

Tom Simons, a U.S. economist at Jefferies, emphasized the need for caution. The cautious sentiment is prevalent among economists.

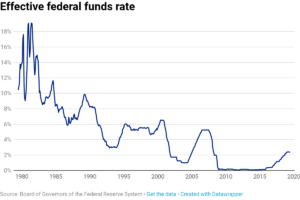

The Fed’s Current Rate

Currently, the Fed’s benchmark rate stands at 5.25% to 5.5%. This is the highest level seen in 23 years. Chair Jerome Powell and other policymakers have indicated that a cut is coming. The challenge lies in determining the size of that cut.

Balancing Risks

The Fed faces a crucial decision. Should they risk reigniting inflation by cutting by 50 basis points? Or should they be cautious and limit the cut to 25 basis points? She noted that the Fed must weigh the risks of inflation against those of a potential recession.

Insights from Former Officials

Former Dallas Fed President Robert Kaplan predicted an interesting debate within the FOMC. Some members may want to move quickly to avoid falling behind the economy.

The Importance of the ‘Dot Plot’

One critical aspect of this meeting is the “dot plot.” This grid indicates where Fed officials see interest rates heading in the coming years. The upcoming dot plot will be particularly significant, as it will provide insights into projections for 2027. Previously, FOMC members forecasted just one rate cut for the remainder of the year. That number is likely to increase.

Economic Projections Ahead

The Summary of Economic Projections (SEP) will accompany the dot plot. This document offers unofficial forecasts for key economic indicators, including unemployment and inflation. Analysts expect that the unemployment rate forecast will rise. The current jobless rate is 4.2%, higher than earlier estimates.

Adjustments to Inflation Forecasts

Inflation forecasts will also be adjusted. In June, core inflation was estimated at 2.8% for the year. However, this figure is likely to be revised downwards based on recent trends. Economists note that inflation seems to be on track to undershoot previous estimates. Goldman Sachs economists suggested that a key focus of the meeting will be labor market risks.

The Post-Meeting Statement

Following the rate decision, the Fed will issue a statement. This statement will reflect the expected rate cut and any additional guidance. Markets will react quickly to this announcement. The statement will be released at 2 p.m.

Goldman Sachs anticipates a more confident tone regarding inflation in the statement. However, specific forward guidance is unlikely.

Following the Federal Reserve’s decision on interest rates, the post-meeting statement serves as a crucial communication tool for policymakers. This statement is released at 2 p.m. ET, immediately after the Federal Open Market Committee (FOMC) meeting concludes. It outlines the Fed’s rationale for the rate decision and offers insights into future monetary policy directions.

The statement typically begins with a summary of current economic conditions, highlighting key indicators such as inflation, employment rates, and overall economic growth. By contextualizing their decisions within the broader economic landscape, the Fed aims to provide clarity to markets and the public. For instance, if inflation rates are declining, the statement may emphasize the need for continued caution in monetary policy adjustments.

In addition to detailing the rate change, the statement often addresses the Fed’s dual mandate of promoting maximum employment and stable prices. This balance is critical, as it informs stakeholders about the Fed’s ongoing commitment to fostering a healthy economy. For example, if unemployment rates are rising, the statement might reflect concerns about labor market stability, signaling that more aggressive cuts could be warranted.

Final Thoughts

This week’s Fed meeting holds significant potential for financial markets. The uncertainty around the rate cut and the split views among officials create a unique atmosphere. All eyes will be on the outcomes of this meeting, as they could influence economic conditions for months to come.

Whether the Fed opts for a cautious or aggressive approach, their decision will be closely watched. Investors and analysts alike will be eager to understand the implications for the economy. Only time will reveal the true impact of this pivotal meeting.