5 Market Shifts: ADP Weakness and Tesla Surge.Dow Jones Futures Drop on Weak ADP Report; Tesla’s Big Move

Market Overview

Dow Jones futures and other major stock indexes experienced a modest decline Thursday. This drop followed a weaker-than-expected ADP jobs report. Investors are closely watching economic indicators, which can impact market trends.5 Market Shifts: ADP Weakness and Tesla Surge

ADP Jobs Report Impact

The ADP jobs report is a significant economic indicator. The latest report showed weaker job growth than anticipated. This data often influences market movements. A lower job growth number can signal potential economic slowdowns. Consequently, investors adjust their portfolios based on these insights.

Futures Market Reaction

Meanwhile, tech-focused Nasdaq 100 futures saw a larger decline of 0.6%. These early movements reflect investor reactions to economic data.

Treasury Yields and Oil Prices

The 10-year Treasury yield remained steady at 3.77%. This stability in yields suggests no immediate concern about inflation or interest rates. Oil prices, on the other hand, saw an increase. West Texas Intermediate futures were trading around $69.50 per barrel. Rising oil prices can impact various sectors, including transportation and manufacturing.

ETF Performance

Exchange-traded funds (ETFs) also showed declines. The Invesco QQQ Trust fell by 0.6%. The SPDR S&P 500 ETF dropped by 0.3%. ETFs are a popular way for investors to gain exposure to a broad range of stocks. Their performance often reflects the broader market trends.

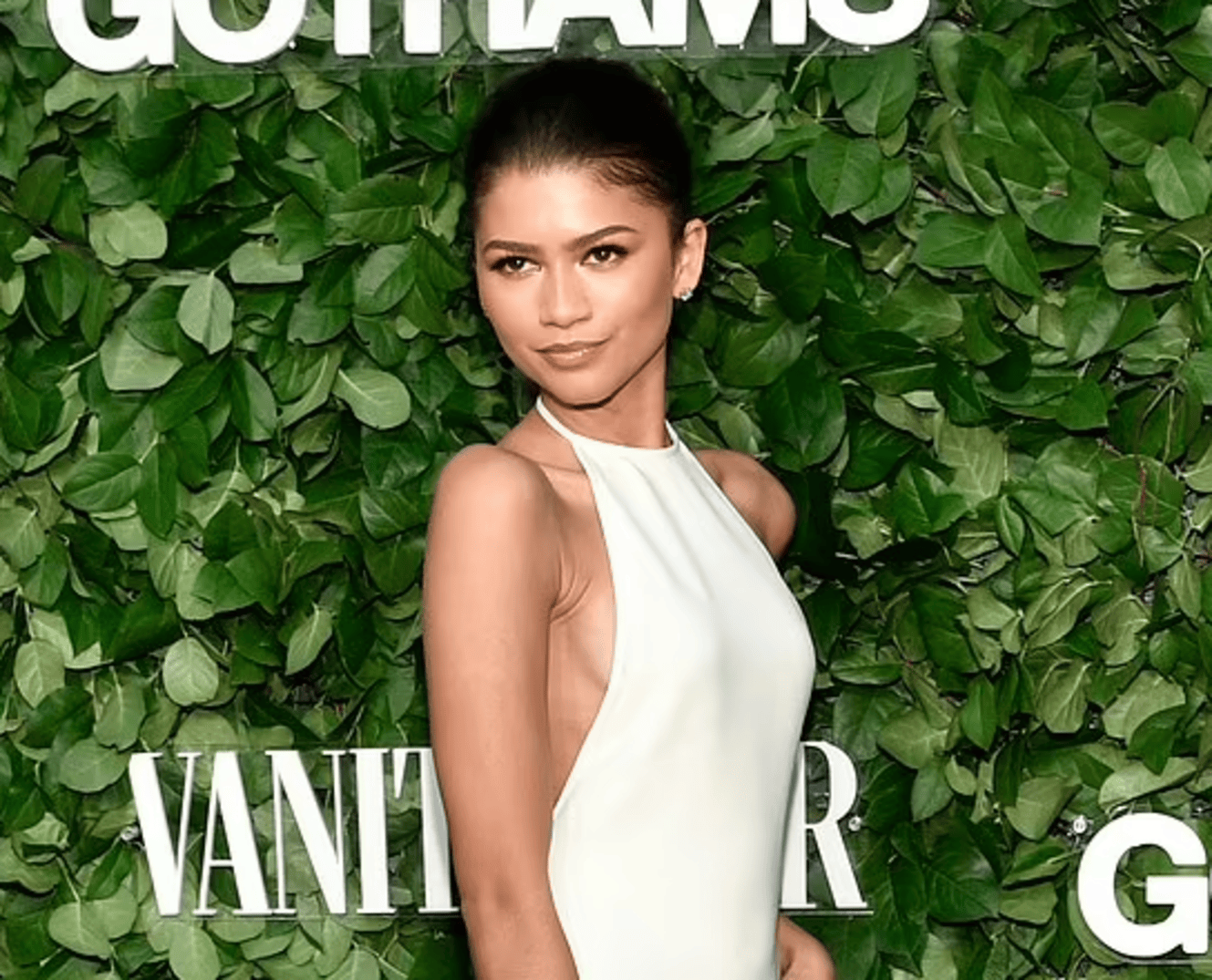

Tesla’s Surge

Tesla stock stood out amid the market’s overall decline. The stock surged nearly 3% on Thursday morning. This jump followed Tesla’s announcement about its self-driving software plans. The company revealed it intends to launch its full self-driving driver assistance software in Europe and China.

Details of Tesla’s Announcement

Tesla’s self-driving software will be rolled out in the first quarter of 2025. This rollout is contingent on regulatory approval.

Global Expansion Plans

Tesla’s expansion into Europe and China represents a major growth opportunity. These markets are large and growing. Regulatory approval will be crucial for Tesla’s plans. If successful, this expansion could boost Tesla’s global market share.

Comparing Market Movers

While Tesla’s announcement garnered attention, other stocks also play a role in the market’s dynamics. For instance, MakeMyTrip, Tyler Technologies, and DaVita are noteworthy. These companies are under focus as investors evaluate their performance and potential.

When evaluating market movers, it’s essential to look beyond just the high-profile tech giants and consider a broader range of companies making significant impacts. Market movers are stocks or sectors that exhibit substantial price movements due to various catalysts, including earnings reports, industry developments, or macroeconomic trends.

Take Tesla, for example. Recently, the company’s stock surged due to its announcement of new self-driving software. This news not only highlights Tesla’s role as a market leader in automotive innovation but also demonstrates how a single company’s strategic move can significantly influence its stock price and investor sentiment. Tesla’s growth prospects are closely linked to advancements in autonomous driving technology, which can create substantial market volatility and opportunity.

In contrast, other companies like MakeMyTrip, Tyler Technologies, and DaVita also play crucial roles in the market but in different sectors. MakeMyTrip, an online travel agency, is affected by travel trends and economic conditions that influence consumer spending on travel. Tyler Technologies, which provides software solutions for public sector entities, is influenced by government budgets and technology adoption rates. DaVita, a healthcare company specializing in dialysis services, is impacted by healthcare policies and demographic trends related to chronic diseases.

Alternative Investment Opportunities

In addition to Tesla and Amazon, other stocks offer significant gains. One such stock has outperformed many in the “Magnificent Seven.” This lesser-known stock may provide better returns than more prominent tech giants. Investors are increasingly looking beyond the big names for growth opportunities.

In the ever-evolving landscape of investing, exploring alternatives beyond the well-trodden paths of major tech giants like Amazon and Tesla can be highly rewarding. While these industry leaders certainly capture a lot of attention, they are not the only options for investors seeking substantial returns.

These can include sectors such as biotechnology, renewable energy, and emerging markets, which may present significant growth potential. For instance, biotech companies often develop groundbreaking treatments and technologies that can lead to explosive stock gains when they achieve regulatory approval or make significant clinical advancements.

Renewable energy is another sector gaining traction. With global emphasis shifting towards sustainability, companies involved in solar, wind, and other green technologies are attracting increasing investment.

Additionally, emerging markets offer intriguing possibilities. These regions are characterized by rapid economic growth and expanding middle classes, presenting fertile ground for investments in infrastructure, consumer goods, and technology. Although these markets can be volatile, they also provide opportunities for high returns as they develop and modernize.

Venture capital and private equity are alternative investment avenues where investors can support innovative startups and established businesses outside the public market. While these investments often require a higher risk tolerance and longer time horizons, they can yield substantial rewards if the ventures succeed.

Real estate, particularly in emerging urban areas, also presents investment opportunities. While exploring these opportunities requires careful research and a willingness to embrace a higher level of risk, the potential rewards can be substantial.

Conclusion

Thursday’s market activity reflects a mix of economic signals and company-specific news. The weaker ADP jobs report has contributed to modest declines in major indexes. However, Tesla’s planned rollout of self-driving software has injected some excitement into the market. As always, investors must stay informed about both macroeconomic indicators and individual company developments to make well-informed decisions.