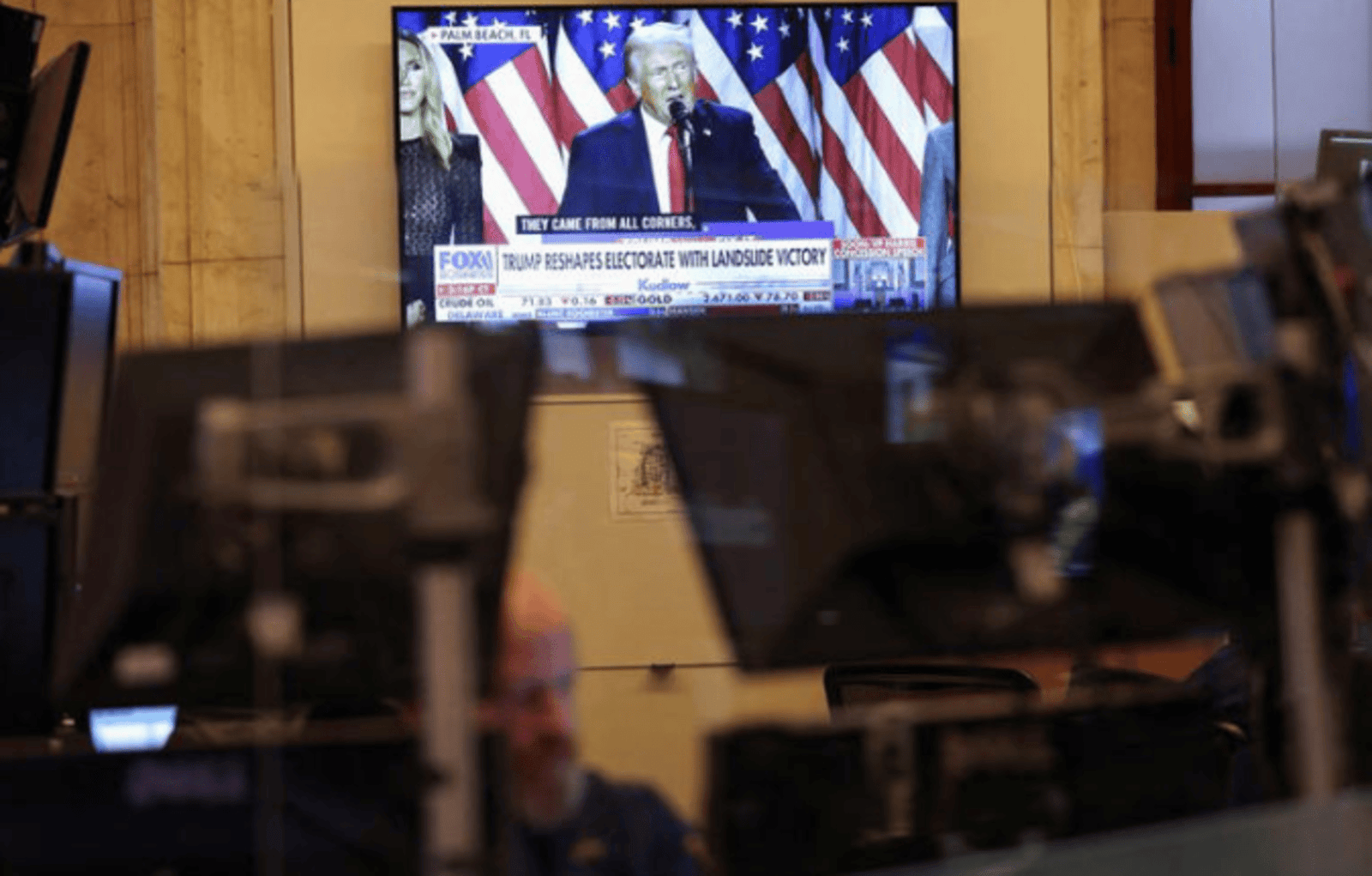

62 percent Warn Trumps Policies Could Raise Debt. Most Americans Expect Trump’s Policies to Increase U.S. Debt, New Poll Reveals

In a recent Reuters/Ipsos poll, many Americans expressed concerns that President-elect Donald Trump’s policies could drive up the national debt. However, opinions on this matter varied sharply between Republicans and Democrats, with Democrats showing significantly more apprehension about the potential fiscal impact. 62 percent Warn Trumps Policies Could Raise Debt

Key Findings from the Reuters/Ipsos Poll

The survey, which ran for two days, collected responses from a sample of 1,471 U.S. adults. It revealed that 62% of participants expect the national debt to rise under Trump. This expectation cuts across various demographics but highlights stark partisan differences. Among Democrats, 94% share this concern, compared to only 34% of Republicans.

These findings point to a deep divide over Trump’s approach to economic policy, particularly his plans for tax cuts, tariffs, and immigration. With Trump set to assume office and Republicans likely gaining control of both chambers of Congress, the nation is preparing for significant policy shifts.

Diverging Concerns Between Republicans and Democrats

Many Americans anticipate that Trump’s economic strategies will raise the national debt. However, Republicans and Democrats view this issue quite differently. The poll showed that 89% of Democrats are deeply worried about Trump’s fiscal policies, fearing they could increase the debt significantly. Conversely, only 19% of Republicans share this concern.

Republican leaders argue that Trump’s tax cuts have previously increased federal revenue, suggesting the same outcome for his current policies. They see tax cuts as an opportunity for further economic growth, rather than a path to higher debt.

Trump’s Economic Agenda: Tax Cuts and Spending Plans

Throughout his campaign, Trump emphasized plans to cut taxes for businesses and workers while increasing tariffs on imports. He also proposed new spending on Social Security and mass deportations of undocumented immigrants. While these measures appeal to many of Trump’s supporters, critics argue they could lead to skyrocketing government debt.

One major point of debate surrounds Trump’s proposed tax cuts. According to the nonpartisan Committee for a Responsible Federal Budget, these tax cuts could add $7.5 trillion to the national debt over the next decade. With the federal debt already reaching $35 trillion, many Americans are concerned that further tax cuts could push the debt to unsustainable levels.

The Impact of Tax Cuts on Federal Revenue

Republicans argue that tax cuts boost economic activity, which, in turn, raises federal revenue. Pointing to the gains in tax receipts since 2017, they believe that Trump’s policies have strengthened the economy. Proponents claim that lowering taxes allows businesses to invest and expand, leading to job creation and growth.

However, some economists argue that revenue increases are not enough to offset the cost of the cuts. They believe that tax reductions will further strain the federal budget, leading to even higher deficits and debt. These concerns are amplified by recent projections showing that Trump’s proposed cuts could have a massive impact on the debt over the long term.

Government Spending and Debt: A Complex Balancing Act

While Republicans may push for additional spending cuts and deregulation, some analysts believe this approach may not address the full scope of the issue. The U.S. deficit reached $1.833 trillion in fiscal 2024, fueled by high government spending and debt interest payments exceeding $1 trillion for the first time. With such high interest costs, cutting spending may not be enough to slow debt growth.

Trump’s administration will need to balance tax cuts with spending cuts to prevent the debt from spiraling further. Yet, given the popularity of certain programs, such as Social Security and Medicare, significant cuts in these areas may be challenging. Some experts suggest that without major reforms, reducing the debt may be nearly impossible.

U.S. Government Debt: A Growing Concern

Many Americans remain concerned about the country’s debt, with public debt now exceeding $35 trillion. This figure has been growing rapidly due to various factors, including military spending, healthcare costs, and economic support during the COVID-19 pandemic. The current debt levels mean that interest payments alone account for a significant portion of the federal budget.

In response to these concerns, Trump’s fiscal policies are facing scrutiny. The Reuters/Ipsos poll highlights that while Trump’s supporters may believe in his ability to boost the economy, a large portion of the American public expects his policies to increase the national debt.

Future Debt Projections Under Trump’s Policies

According to experts, the U.S. debt could continue to grow significantly if Trump’s policies are implemented. Projections from the Committee for a Responsible Federal Budget show that his proposed tax cuts alone could add trillions to the national debt over the coming decade.

If debt levels continue to climb, the U.S. may face higher borrowing costs, as investors demand higher interest rates on government bonds. This could create additional financial strain and limit the government’s ability to fund essential services.

The Risks of High Debt and Potential Economic Consequences

Rising debt levels come with various risks. As interest payments consume a larger share of the federal budget, there will be less money available for public services, defense, and infrastructure. Additionally, high debt levels could make it harder for the government to respond to future economic crises.

Experts warn that high debt could also lead to inflation and reduced investor confidence. If investors become concerned about the U.S. government’s ability to manage its debt, they may pull back, leading to further economic instability.

Conclusion: A Divisive Economic Outlook

The Reuters/Ipsos poll shows that Americans are divided on Trump’s fiscal policies. While Republicans remain optimistic, Democrats are more apprehensive about the risks of rising debt. Trump’s proposed tax cuts and spending increases could reshape the U.S. economy, but they also bring significant risks.

With debt already at high levels, managing the country’s finances will be a critical challenge. As Trump prepares to take office, he and Congress face the daunting task of balancing economic growth with fiscal responsibility. The future of the U.S. economy may depend on their ability to find a sustainable path forward.