Protect Your Portfolio After Nvidias Stock Sale. Navigating Market Volatility: How to Protect Your Portfolio Amid Nvidia’s Stock Sales

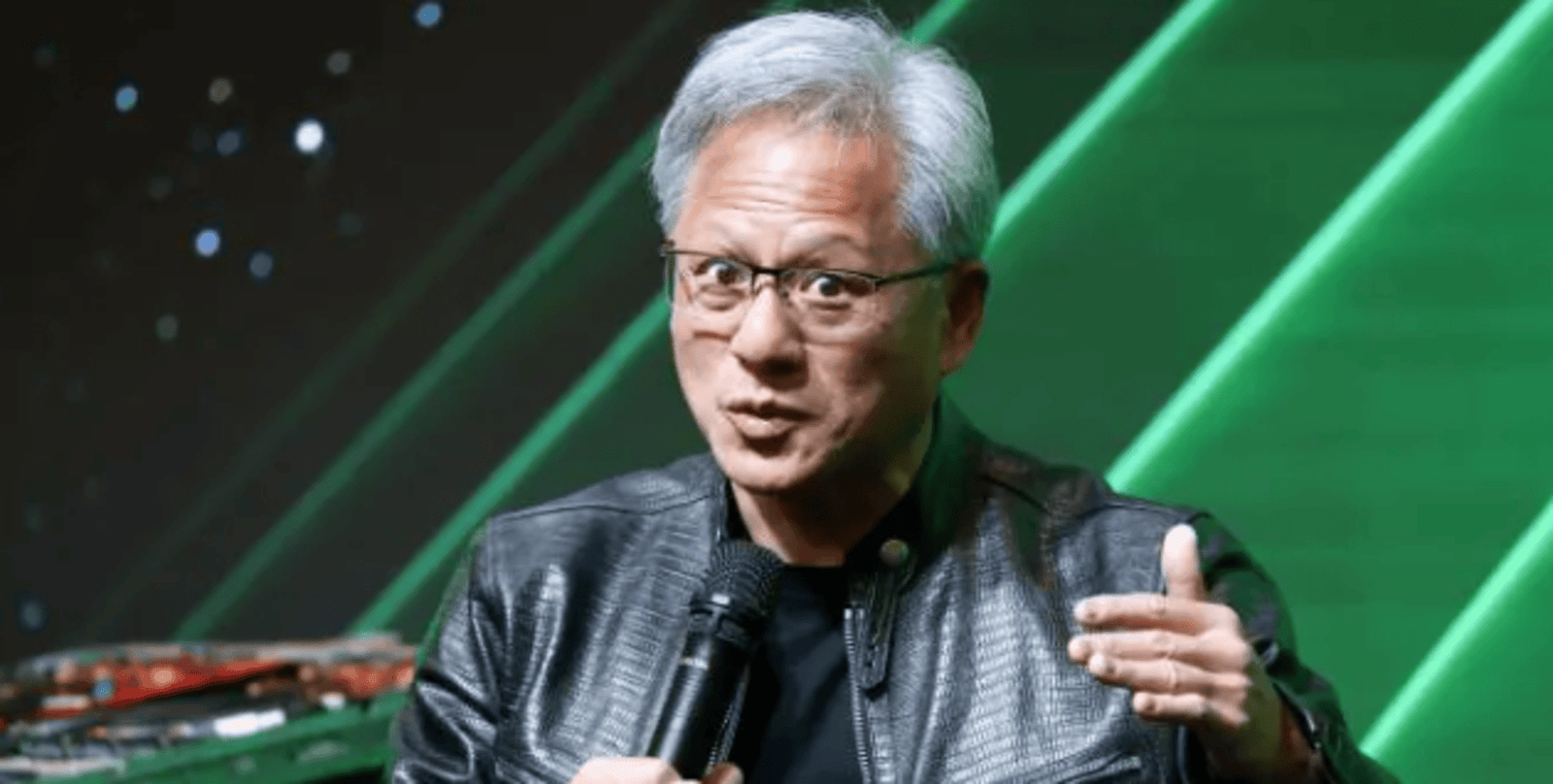

Nvidia’s CEO Jensen Huang, a self-made billionaire, recently sold over $700 million worth of his company’s stock. Protect Your Portfolio After Nvidias Stock Sale

Huang’s Story: From Dishwasher to Billionaire

He started as a dishwasher at Denny’s, working hard to make ends meet. Today, he is the founder and CEO of Nvidia, a company with a market capitalization of $3.17 trillion. Huang’s personal wealth is also impressive, placing him among the wealthiest individuals in the world.

However, despite this immense success, Huang has experienced significant fluctuations in his net worth. Since June, he has lost billions, showcasing the volatility that even top-tier executives face. His decision to sell $700 million in Nvidia stock, though planned, came faster than experts predicted. This brings up important questions about market timing and how investors can safeguard their portfolios against similar risks.

The Challenge of Picking Stocks

As evidenced by Huang’s actions, buying and selling individual stocks can be a risky venture. Even seasoned investors face challenges. Warren Buffett, one of the greatest investors of all time, once remarked that the average person should not attempt to pick stocks. His advice is simple: instead of trying to time the market or select individual stocks, investors should consider more stable and diversified approaches.

For those looking to bypass the complexities of stock picking, alternative trading platforms are available. Such tools can offer a sense of security in a turbulent market.

Market Research Can Fuel Success

One of the key elements in portfolio management is access to reliable market research. Platforms like Moby, which is staffed by former hedge fund analysts, offer comprehensive financial news and stock reports. Moby’s research has consistently outperformed the S&P 500, beating it by an average of 12% over four years. For investors looking to gain an edge, such resources are invaluable.

These platforms help reduce guesswork and offer investors a clear picture of what’s happening in the market.

Protecting Your Portfolio with ETFs

While Huang’s sale of Nvidia stock was a significant move, it serves as a reminder that relying too heavily on individual stocks can be risky. Exchange-traded funds (ETFs) offer a more diversified and stable approach to investing. By spreading investments across various assets, ETFs reduce the impact of volatility in a single stock or sector.

ETFs also provide flexibility, as they can be traded like stocks but come with the benefits of diversification. Investors who wish to avoid the unpredictability of single-stock investments might find ETFs a valuable addition to their portfolios.

Alternative Investment Platforms

Investors seeking new ways to grow their wealth should explore different investment platforms. Public is one such platform that offers commission-free trading. It allows users to buy stocks, ETFs, options, and more. Public also stands out with its high-yield accounts, where investors can park their cash while waiting for the right market opportunities.

The platform’s social features enable users to connect with other investors, share insights, and stay updated on real-time market trends. These features help investors feel more informed and confident in their decisions, making it easier to navigate volatile markets.

Diversifying with Alternative Assets

While traditional stocks and ETFs remain popular, many wealthy Americans are diversifying their portfolios with alternative assets. These include real estate, cryptocurrencies, and even becoming landlords for companies like Walmart and Kroger. Such assets provide an additional layer of security in uncertain markets.

Platforms like Fundrise allow accredited investors to invest in commercial real estate and earn regular distributions. Real estate offers stability that stock markets sometimes lack, making it an appealing option for those seeking steady returns without the daily fluctuations of the stock market.

Lessons from Warren Buffett

Warren Buffett’s investment philosophy emphasizes long-term stability over short-term gains. He has often advised investors to avoid trying to time the market and focus on consistent, long-term growth. His preference for diversified index funds and ETFs has been echoed by financial experts, especially during volatile times.

Buffett’s message is clear: investors should avoid betting on individual stocks, especially in a market prone to sudden swings. By diversifying and focusing on stable, reliable investments, individuals can protect their portfolios against significant losses.

Why Jensen Huang Sold His Stock

Huang’s recent stock sale has left many wondering why he chose to sell at such a rapid pace. According to Yahoo Finance, while his move was pre-planned, it came faster than many expected. Experts believe that Huang’s sale may have been a strategic decision to reduce risk and lock in profits after Nvidia’s massive growth in recent years.

However, for regular investors, following in the footsteps of executives like Huang can be risky. Selling large portions of stock may not be the best strategy for those who lack a deep understanding of market conditions. Instead, taking a diversified approach can mitigate risks and lead to more stable, long-term success.

How to React to Market Swings

Market swings are inevitable, but there are ways to protect your financial portfolio.

Conclusion: Protect Your Portfolio Now

The financial world is full of ups and downs, and market volatility is inevitable. Jensen Huang’s recent stock sales highlight the risks of relying too heavily on individual stocks. However, by diversifying, staying informed, and focusing on long-term strategies, you can protect your portfolio from sudden market swings. Use tools like ETFs, research platforms, and cash reserves to ensure your financial future remains secure, no matter what happens in the stock market.