2 Must-Buy Stocks in the AI Server Boom. The AI Server Market Is Booming: Top Stocks to Buy Now

Artificial Intelligence (AI) has revolutionized various industries, transforming how businesses operate and how consumers interact with technology. The rise of AI has created significant investment opportunities, especially in the AI server market. According to projections from Statista, the AI server market is expected to grow to $430 billion by 2033, a tenfold increase. This immense growth opens the door for investors looking to capitalize on the rise of AI servers. 2 Must-Buy Stocks in the AI Server Boom

In this article, we will explore two top companies that are well-positioned to profit from this rapidly expanding market: Dell Technologies and Nvidia. Both companies are making significant strides in AI infrastructure, and their stocks offer attractive upside potential for investors. Below is a detailed look into why these companies should be on your investment radar.

1.Dell Technologies: A Rising Star in the AI Server Market

Dell Technologies (NYSE: DELL) is not only known for its personal computers but has also become a leader in the AI server market. With its focus on infrastructure solutions, Dell is positioned to benefit significantly from the increasing demand for AI servers.

Strong Performance in Infrastructure Solutions

Dell’s infrastructure solutions business has seen robust growth. Last quarter, the company reported a 38% year-over-year increase in revenue from this segment. This growth is driven largely by the accelerating demand for AI servers, which are essential for running complex AI models and managing vast data sets.

While Dell’s PC business still accounts for half of its revenue, its infrastructure segment is expected to be the fastest-growing part of the company in the coming years. The demand for AI infrastructure is showing no signs of slowing down, and Dell is well-equipped to meet this need.

Competitive Advantage in Services and Support

One of Dell’s competitive edges lies in its ability to provide comprehensive services and support to its customers. The company offers advanced air- and liquid-cooled servers, which help reduce the energy costs associated with high-performance computing systems. This capability is critical for customers who need to control the operational costs of running AI-driven workloads.

In addition to servers, Dell provides networking and storage solutions, offering customers a complete package for their AI infrastructure needs. These services have strengthened Dell’s position as a trusted partner for businesses investing in AI technologies.

Addressable Market and Revenue Growth

Management at Dell sees a massive addressable market for AI hardware and services. The company estimates this market to be worth $174 billion, growing at more than 20% annually. Dell’s infrastructure segment is already generating over $40 billion in annual revenue, and this figure is expected to grow as AI adoption continues.

Demand for traditional servers is also rising. Dell has experienced three consecutive quarters of growth in this area, signaling strong market demand. In the coming years, Dell could also see revenue growth from its PC business as consumers upgrade to AI-optimized PCs set to launch in 2025.

Over the long term, Dell’s management anticipates total revenue growth of 3% to 4% annually. Wall Street analysts expect earnings to grow at a much faster rate of 12% annually, driven by higher demand for Dell’s AI solutions and services.

Valuation: A Bargain for Investors

Despite its strong position in the AI server market, Dell’s stock is currently trading at a forward price-to-earnings (P/E) ratio of just 12.8 based on next year’s earnings estimates. This valuation presents a compelling buying opportunity for investors looking to gain exposure to the booming AI infrastructure market.

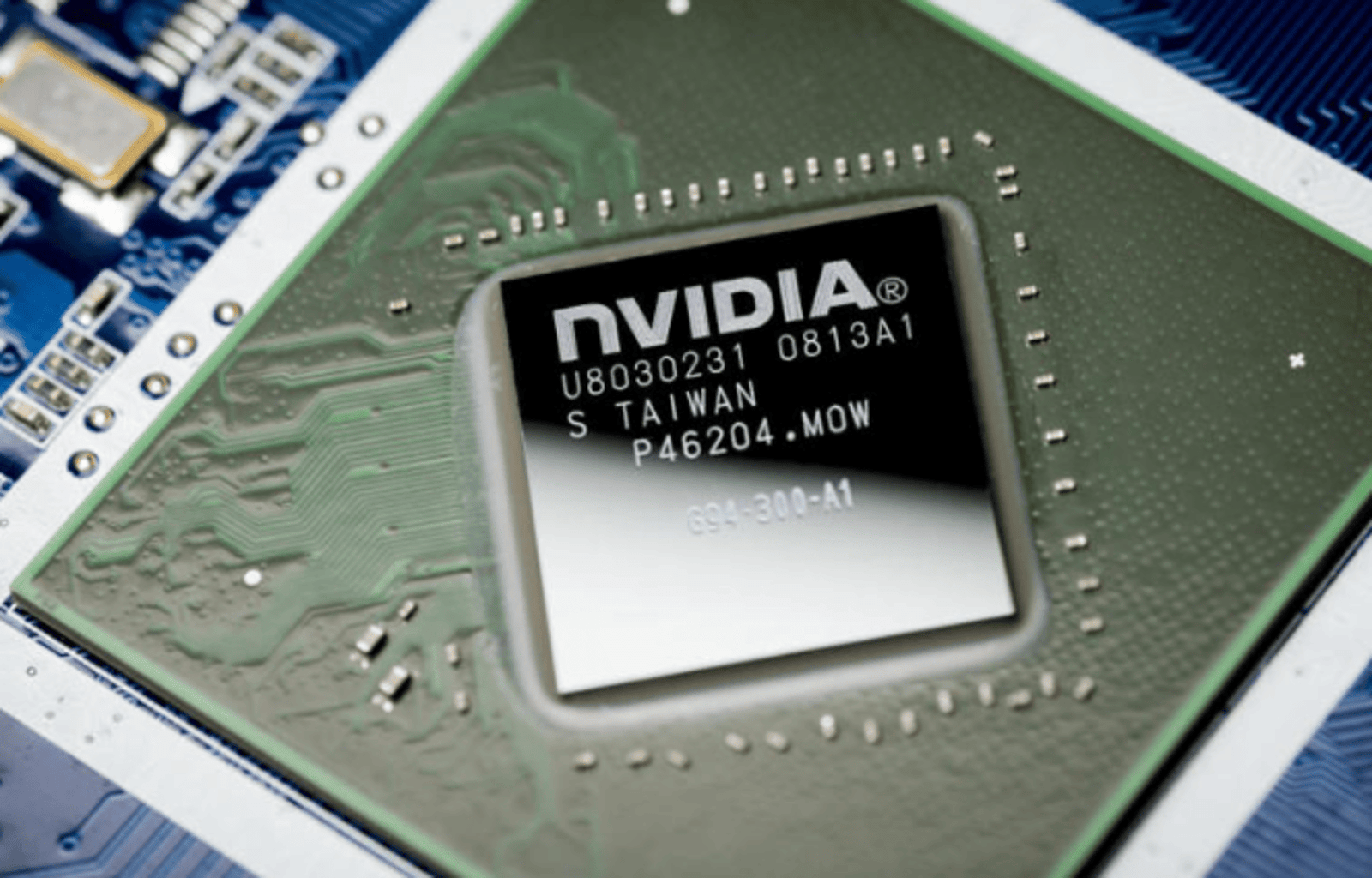

2. Nvidia: The Powerhouse Behind AI Servers

Nvidia (NASDAQ: NVDA) is another key player in the AI server market. The company’s dominance in the graphics processing unit (GPU) space has positioned it as the go-to supplier for AI infrastructure.

Leading the GPU Market

AI servers rely on GPUs to perform their complex computations, and Nvidia has long been the leader in this market. The company holds an 88% share of the add-in board market for GPUs, according to Jon Peddie Research, making it the dominant force in the space.

Nvidia’s GPUs are also essential for AI workloads, giving the company a commanding lead in the AI chip market. As more businesses invest in AI infrastructure, Nvidia is poised to capture a significant portion of this growing demand.

Explosive Revenue Growth

Nvidia has experienced explosive revenue growth in recent years, driven by the widespread adoption of AI technologies. In the company’s fiscal second quarter, which ended in July, revenue grew 122% year over year. Analysts forecast that Nvidia’s revenue will increase by 105% for the full year, with another 42% growth expected in the following year.

A major growth catalyst for Nvidia is its new Blackwell AI computing platform, which is expected to generate billions in revenue over the next few years. This platform will provide the necessary hardware for companies looking to build and scale their AI systems.

High Demand for AI Chips

Nvidia’s GPUs are not only used by large tech companies but are also in high demand by AI start-ups and cloud service providers. The company’s strong relationships with its customers have helped solidify its lead in the AI chip market. Nvidia’s position as the leading supplier of GPUs for AI servers gives it a unique advantage in the rapidly expanding AI infrastructure market.

Conclusion: Act Now to Profit from AI’s Growth

With the AI server market projected to grow tenfold by 2033, now is the time for investors to act. Dell Technologies and Nvidia are two leading stocks that can help you profit from the rise of AI infrastructure. Both companies are well-positioned to capitalize on this booming market, and their stocks offer attractive valuations for long-term investors.

By investing in AI infrastructure, you can potentially earn significant returns while supporting the technological advancements that will shape the future of business and innovation. Don’t miss out on the opportunity to profit from the explosive growth of AI servers.