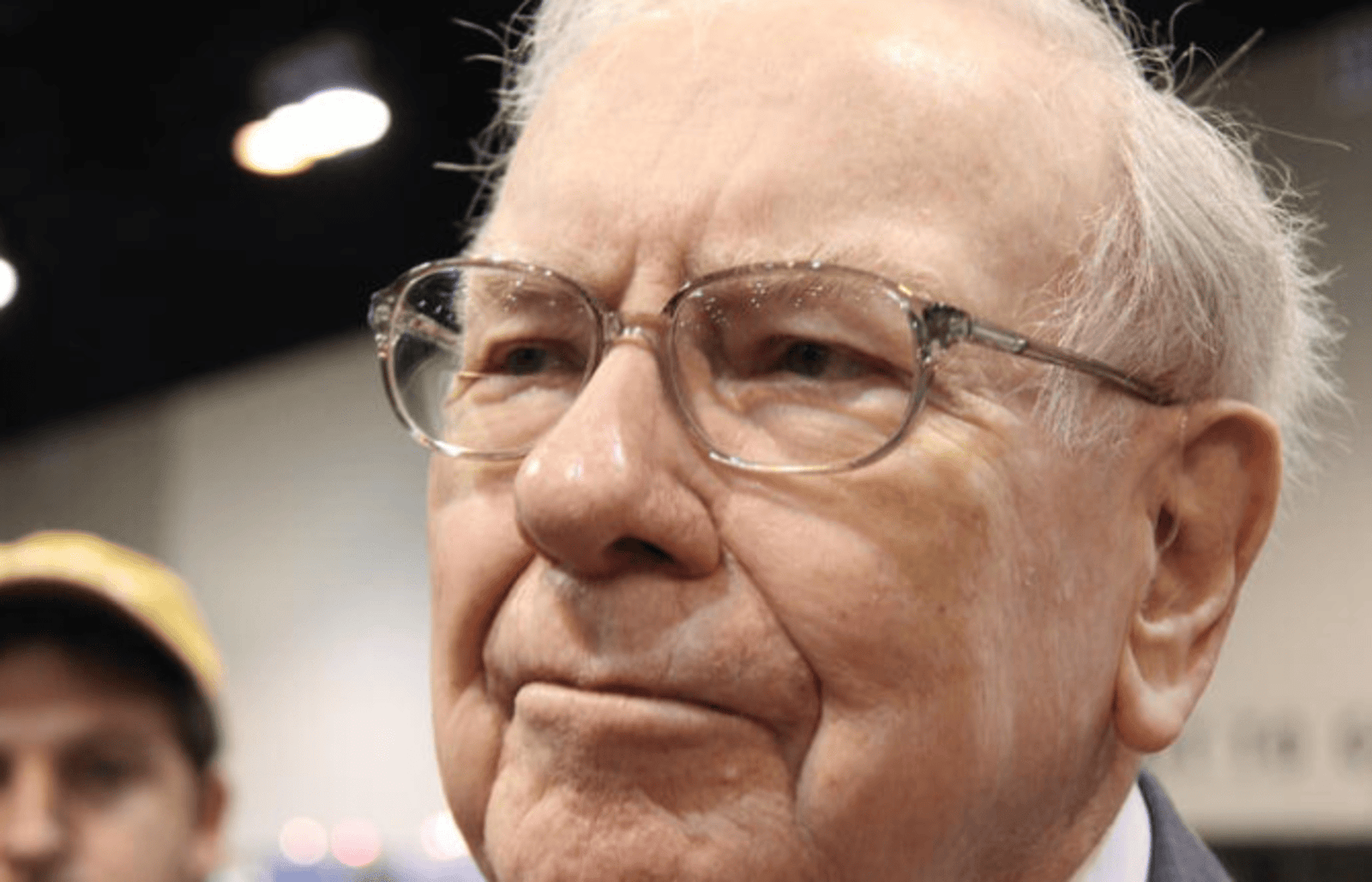

Buffett 133B Selloff and Bold 550M Bet. Warren Buffett’s 2024 Stock Moves: A Year of Bold Decisions

Warren Buffett has captured headlines throughout 2024. His investment strategies have long been a guide for investors worldwide. This year, his decisions, especially large-scale sales, are raising eyebrows. Buffett 133B Selloff and Bold 550M Bet

These transactions represent some of the biggest sales in Berkshire Hathaway’s history. However, one small purchase during the third quarter is drawing attention for a different reason.

Warren Buffett’s 2024 stock moves, including bold sales and a notable small purchase in the third quarter, will be discussed here

Massive Stock Sales in 2024

Buffett’s stock sales in 2024 were historic. The $133 billion figure isn’t just a number. it’s a message.

Apple: The Biggest cut

Buffett sold over two-thirds of Berkshire’s stake in Apple. This move shocked many investors.

Why did he sell? Analysts believe Buffett views Apple as trading near its essential value. He often emphasizes avoiding overvalued stocks. Selling Apple aligns with his principle of buying undervalued companies.

Bank of America: Another Surprising Sale

Yet, in 2024, he reduced Berkshire’s position in it.

The financial sector has faced challenges this year. Rising interest rates and market unpredictability may have influenced Buffett’s decision.

Is the Market Expensive?

These sales have sparked debate. Some experts see Buffett’s moves as a warning. The stock market might be expensive. Buffett’s sales suggest caution.

Berkshire’s Portfolio

Berkshire Hathaway still holds an impressive portfolio even with the large sales. Berkshire Hathaway still holds an impressive portfolio. It includes $300 billion worth of ownership.

A Select Few Are Safe

Only a few companies have avoided Buffett’s trimming this year. His focus has been on optimizing Berkshire’s holdings.

This disciplined approach showcases Buffett’s long-term vision. Investors might want to take note of his careful stock selection.

The Challenge Buffett Faces

Managing $600 billion in assets isn’t easy. Berkshire Hathaway includes not only stocks but also cash and Treasury bills.

Liquidity Is Key

This helps him seize opportunities during market downturns.

Selling stocks allows him to maintain this flexibility. The $133 billion in sales may reflect a need for liquidity.

Patience in an Overheated Market

Buffett is known for his patience. He doesn’t chase market trends.

This year’s stock sales align with his belief in value investing. Overvalued markets don’t appeal to him.

The $550 Million Purchase That Stands Out

Among the massive sales, one small purchase caught attention. During the third quarter, Buffett bought $550 million worth of Domino’s Pizza.

Why Domino’s Pizza?

Domino’s isn’t a tech giant or a financial powerhouse. Yet, Buffett saw potential in it.

The purchase represents 3.7% of Domino’s total market value. For Berkshire, it’s a tiny fraction of the portfolio—just 0.2%.

But the message is clear. Buffett still believes in growth opportunities.

What This Means for Investors

The Domino’s purchase signals Buffett’s confidence in the company. While he avoids overpriced stocks, he seeks value in smaller, promising firms.

Investors should note this strategy. Big gains can come from identifying unrecognized companies.

Lessons for Individual Investors

Buffett’s 2024 actions offer key perception. Here’s what individuals can learn:

1. Avoid Overvalued Stocks

Buying overvalued stocks often leads to poor returns.

2. Diversify Your Portfolio

Even after selling $133 billion in stocks, Berkshire remains diversified.

3. Stay Patient

Buffett’s decisions reflect patience. He waits for the right opportunities. Individual investors should follow this approach.

4. Seek Value

The Domino’s purchase shows Buffett’s commitment to value investing. Finding undervalued companies can lead to success.

Broader Market Perspective

Buffett’s moves aren’t just about Berkshire Hathaway. They offer insights into the broader stock market.

Rising Concerns About Overvaluation

Many experts believe the market is overpriced. Buffett’s sales may signal a need for caution.

Shifts in Investment Trends

Tech and financial stocks dominated 2024. But Buffett’s focus on companies like Domino’s suggests a shift.

Investors should monitor these trends closely.

The Role of Cash in Buffett’s Strategy

Cash plays an important role in Buffett’s investment approach.

A War Chest for Opportunities

Berkshire’s cash reserves provide flexibility. During downturns, this cash can be used to buy undervalued assets.

Why Liquidity Matters

Buffett understands the importance of liquidity. Selling $133 billion in stocks ensures Berkshire is prepared for any scenario.

1. Strong Fundamentals

Domino’s has shown consistent growth. Its focus on delivery and digital innovation has paid off.

2. A Competitive Advantage

Domino’s stands out in the competitive fast-food industry. Buffett likely sees this as a sustainable edge.

3. Long-Term Potential

The $550 million purchase signals belief in Domino’s future. Investors should watch how this investment performs.

Final Thoughts

Warren Buffett’s 2024 moves highlight his unmatched investment wisdom. His massive sales warn of overvaluation. Yet, his small Domino’s purchase shows faith in selective opportunities.

For investors, the lessons are clear. Stay patient. Avoid overpriced stocks. Seek value where others overlook it.

Buffett’s actions may seem bold, but they align with his principles. Following his lead could help investors navigate today’s challenging market.