Nvidias Journey to a 4 Trillion Valuation. Nvidia’s Path to a $4 Trillion Market Cap

Nvidia, the leading maker of graphics processing units (GPUs), is close to reaching a major milestone: a $4 trillion market cap. The company is currently valued at about $3.6 trillion, so it only needs to rise in value by 11% to hit this mark. If Nvidia achieves this, it will become the first company in history to reach a $4 trillion valuation, surpassing Apple, which has been the world’s most valuable company. Nvidia Journey to a 4 Trillion Valuation

The Race to $4 Trillion

Apple was the first company to reach $1 trillion, $2 trillion, and $3 trillion in value. The main question is whether Nvidia can achieve this milestone before Apple, which needs to grow by 16% to catch up. While the competition between these tech companies is interesting, Nvidia’s growth is particularly notable. The company has succeeded due to its innovative technology and the rising demand for GPUs, which are essential for training artificial intelligence (AI) models.

Nvidia’s Rapid Growth

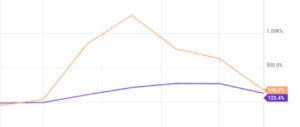

The surge in demand for Nvidia’s products has been most noticeable in the AI sector. AI hyperscalers are purchasing Nvidia GPUs in bulk to build the necessary infrastructure to train their models. As a result, Nvidia has seen its revenue increase at an unmatched speed, with some quarters reporting revenue increases of over 300%.

Profit Margins Soar

Nvidia has grown its revenue and increased its profit margins significantly. The company has met the rising demand without hiring many new employees or increasing its production capacity. This efficiency has helped Nvidia’s profits grow much faster than its revenue.

Nvidia has used its resources to take advantage of the growing demand for GPUs. This approach helps the company keep its profits high. This is one of the key reasons for the company’s ability to scale its business so rapidly.

Facing Slower Growth

Nvidia is experiencing impressive growth, but it is starting to face challenges as it compares its results to previous years. While the company’s revenue is still increasing quickly, that growth is expected to slow down a bit.

For the third quarter of the fiscal year 2025, Nvidia expects to earn $32.5 billion. This represents an 80% growth rate. While this is impressive, it shows a decline from earlier growth rates. Slower growth is a normal part of the business cycle, and Nvidia will likely see this as it follows the strong gains from previous years.

Even with the slowdown, Nvidia is still projected to see strong growth in the next year. Wall Street analysts forecast a 45% increase in revenue for fiscal year 2026, which reflects continued expansion in the AI sector.

Nvidia’s Stock Price and Valuation

Quarterly Growth Projections

Nvidia has already set high expectations for its upcoming earnings report. For the third quarter of fiscal year 2025, the company expects an 8.3% increase in revenue from the previous quarter. If the company can meet or exceed these expectations, it could see its stock cross the $4 trillion market cap before the end of 2024.

If Nvidia meets its growth targets, it could soon become one of the most valuable companies in the world. This would solidify its top position. However, if Nvidia’s earnings fall short, Apple could take the lead in the race to reach a $4 trillion valuation.

The Road Ahead for Nvidia

Nvidia’s ability to continue growing at its current pace will be crucial in determining whether it can hit the $4 trillion valuation. The company’s focus on AI has positioned it well for future growth, but it will need to maintain its competitive edge in an increasingly crowded market.

As more industries use AI and machine learning, the need for strong GPUs will stay high. Nvidia is in a good position to gain from this trend, but it will also compete with companies like AMD and Intel.

Even with these challenges, Nvidia leads the GPU market and is closely tied to the AI industry. This position may help the company keep growing. If Nvidia keeps innovating and attracting new customers, it might reach a $4 trillion valuation sooner than expected.

Nvidia Maintain Its Growth or Not?

Nvidia’s success comes from its ability to innovate and meet the needs of the growing AI market. The company makes graphics processing units (GPUs) used in many industries, including gaming and healthcare. Their GPUs are versatile and play an important role in developing new technologies.

In particular, Nvidia’s GPUs are critical for AI model training. AI models need a lot of computing power, and Nvidia’s GPUs are good for this job . As more people want AI, more people will want Nvidia’s products.

Nvidia has grown quickly, raising high expectations among investors. They hope Nvidia will keep leading the market and deliver good returns. However, if Nvidia’s growth slows more than expected, its stock price could drop, delaying its goal of reaching a $4 trillion valuation.

Nvidia’s Competitive Advantage

Nvidia has a significant competitive advantage over its rivals. The company is a leading provider of high-performance GPUs for AI and machine learning. Its products are considered the best on the market. This strong reputation has helped the company secure long-term contracts with major players in the AI industry.

Additionally, Nvidia’s research and development efforts have allowed it to stay ahead of the competition. This has enabled Nvidia to maintain its leadership position in the GPU market and expand its reach into new industries.

Conclusion:

Nvidia’s Future Outlook

Looking ahead, Nvidia is well-positioned to continue its growth and may very well become the first company to hit a $4 trillion market cap. The company leads the GPU market and has a strong presence in AI. This gives it a big advantage over its competitors.

Nvidia’s stock is currently valued high, meaning many investors expect a lot of future growth. If Nvidia’s growth slows down more than anticipated, its stock price could drop. However, Nvidia still has strong potential. Its innovative products continue to create demand. With the growth of AI and machine learning, people are likely to need Nvidia’s products for a long time. As long as Nvidia keeps its competitive edge, it is likely to keep growing and could soon become one of the world’s most valuable companies.