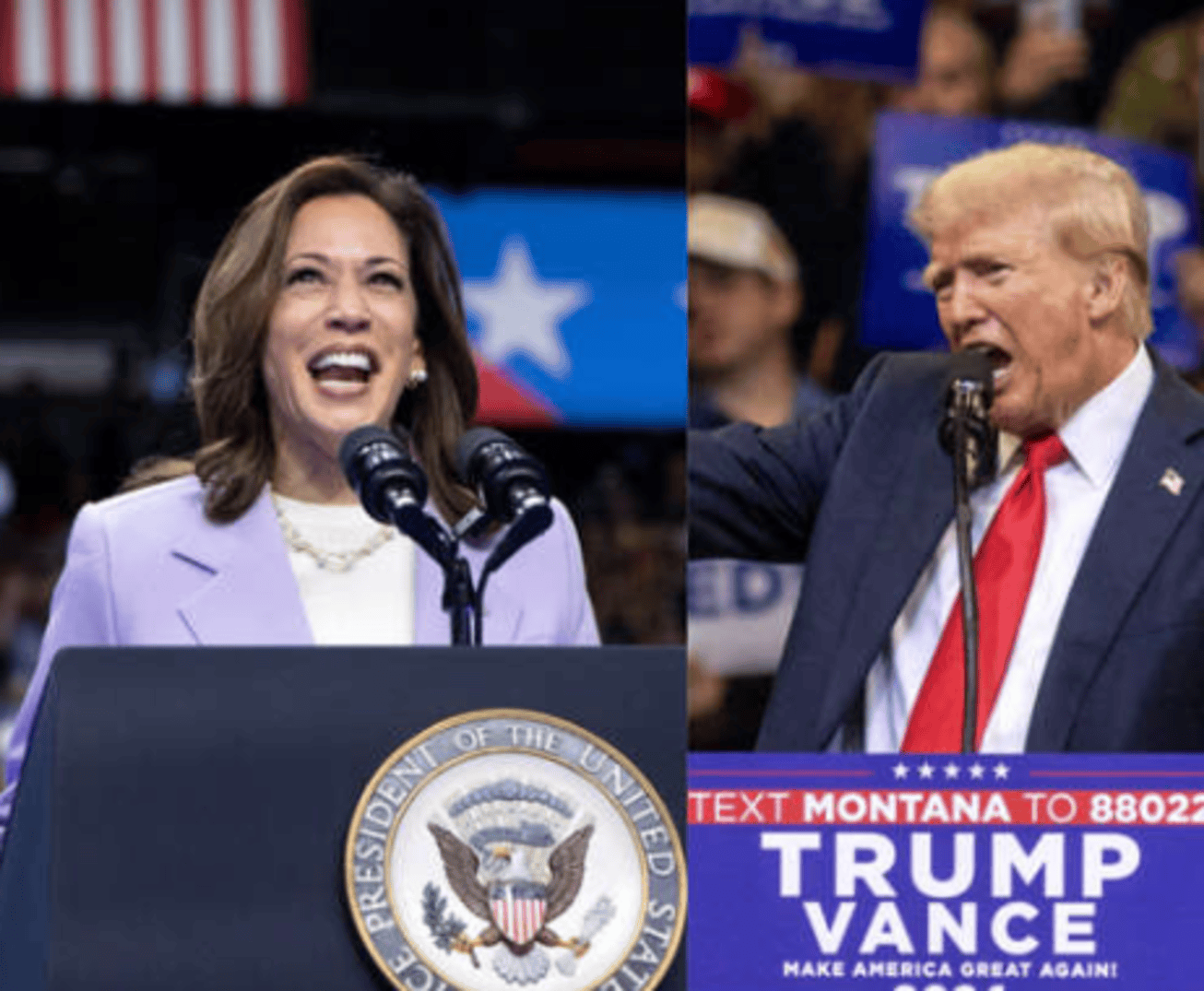

Why Wall Street Bets on Trumps 2024 Victory. Wall Street’s Take on the Upcoming Presidential Election

Investor Sentiment and Market Perceptions

Wall Street holds diverse opinions. A recent survey of 119 investors showed a tilt toward Donald Trump. About 53% of those surveyed believe he will win over Kamala Harris. This sentiment reflects broader market trends. Why Wall Street Bets on Trumps 2024 Victory

The Markets Signal Confidence in Trump

Financial markets have started to react. Many investors think a Trump presidency would benefit specific sectors. Energy, finance, and industrials are expected to perform well under his policies. Billionaire Stanley Druckenmiller shared this perspective. He stated that the market seems “very convinced” of a Republican victory.

Investor Sentiment and Market Perceptions

Big Names Weigh In

While critical of Trump, Griffin still predicted a victory. He described the race as close but slightly leaning toward Trump. It was noted, however, that the situation feels like a “coin toss.”

Impact on Specific Industries

Analysts believe fossil fuel and industrial companies would thrive under Trump. These sectors align with his policies. On the other hand, renewable energy and ESG (environmental, social, and governance) investments might face challenges. Retail could also be affected.

A Look Back at 2016

Wall Street is cautious. In 2016, mainstream investors did not expect Trump’s win. Hillary Clinton was widely favored. When Trump triumphed, markets had to adjust quickly. This time, the investment world is more prepared.

Betting Markets and Their Influence

Betting markets provide an interesting insight. These platforms have leaned toward Trump. This trend coincides with what many financiers are witnessing. The expanding presence of online gambling has amplified the relevance of these markets. They have shown more support for Trump as the campaign unfolds.

Support from Billionaire Investors

Elon Musk, a high-profile billionaire, has shown his support. This adds weight to Trump’s campaign. Musk’s influence spans multiple sectors, from technology to finance. Such endorsements can shift perceptions and market expectations.

European Stock Market Reactions

The potential impact isn’t limited to the U.S. European stocks have also shown reactions. Analyst Emmanuel Cau of Barclays noted this shift. Stocks were trading at discounts due to tariff concerns. This reflects the international reach of U.S. election outcomes.

The Role of Christophe Barraud

Christophe Barraud, a highly respected economist, also predicted a Trump win. His forecasts carry weight in financial circles. He is known for accurate economic predictions. His stance on this election has caught my attention.

ESG and Renewables Face Uncertainty

Trump’s policies may pose challenges for some sectors. Renewable energy might struggle if he wins. ESG investments could see slowed momentum. These areas align more with progressive policies. The contrast is sharp with Trump’s pro-industrial stance.

The Potential for Market Surprises

Despite these predictions, Wall Street remains cautious. Unexpected shifts can happen. The 2016 election serves as a reminder. Investors know that markets can be caught off guard. This acknowledgment keeps them vigilant.

GOP Supporters in the Financial World

Trump’s campaign has the backing of influential GOP donors. Ken Griffin is among them. While Griffin criticized Trump in the past, he remains hopeful for a Republican win. His views influence a significant portion of the financial community.

Historical Market Reactions to Elections

Past elections have shown how markets can react. Uncertainty leads to volatility. In 2016, market adjustments followed Trump’s victory. Investors now prepare more proactively. However, no outcome is ever fully predictable.

Stan Druckenmiller’s Insight

Druckenmiller’s opinions are closely watched. His remark about markets being “very convinced” of a Trump victory highlights confidence. Investors listen when figures like Druckenmiller speak. His views often signal larger trends.

Hedge Funds and Private Investors

The survey from SumZero sheds light on private investors. These groups handle substantial amounts of capital. Their collective opinions hold power. A majority believing in Trump’s victory affects investment strategies.

Kamala Harris: The Democratic Challenger

Kamala Harris represents a different vision. Her policies may favor renewables and ESG initiatives. Investors watching this race see stark policy differences. Harris could bring a shift in market dynamics.

The Race Remains Close

Despite these trends, it’s not a guaranteed outcome. Griffin described it as nearly a “coin toss.” The political landscape is unpredictable. Factors can change rapidly, especially in a heated campaign.

Global Implications of the Election

A Trump win has implications beyond U.S. borders. Tariff policies could affect global trade. European and Asian markets watch closely. The international financial community prepares for potential changes.

Summary of Investor Strategy

Investors are positioning themselves. Pro-Trump sentiment suggests adjustments in portfolios. Energy and industrial stocks are being monitored. However, diversification remains key. Caution is still prevalent.

Investors are carefully considering their strategies as the presidential election nears. A prevailing belief in Wall Street points to a potential Trump victory, which has led to distinct shifts in investment approaches. Those confident in a Trump win are adjusting their portfolios accordingly, focusing on sectors that are expected to thrive under his policies. Energy companies, particularly those involved in fossil fuels, are seeing increased attention. Industrial stocks are similarly being monitored due to their alignment with pro-business, deregulation-focused policies.

Financial experts understand that despite these signals, diversification remains a critical aspect of any investment plan. The uncertainty of election outcomes means hedging is essential. Even as some investors place bets on Trump’s return, many maintain a balanced approach to minimize risks if predictions do not hold true. Sectors such as renewable energy and ESG (environmental, social, and governance) investments could face setbacks under a Trump administration. However, should Kamala Harris secure victory, these same sectors might receive renewed vigor and investment.

Final Thoughts on Wall Street’s Predictions

Wall Street leans toward Trump. Betting markets, surveys, and billionaire endorsements support this. Yet, unpredictability is a constant in elections. Investors brace for all possibilities. The outcome will shape markets and sectors for years to come.