2 AI Stocks Poised for a Big Split

Stock splits are a common yet significant event in the financial world. For instance, if a company’s stock price is exceptionally high, a split can make it more affordable and attractive to individual investors.

In this article, we’ll focus on two artificial intelligence (AI) companies that may be preparing for a stock split. This move could be a sign of their growth and potential, reflecting their increasing value and investor interest. 2 AI Stocks Poised for a Big Split

Understanding Stock Splits

For example, a 2-for-1 stock split means that shareholders will receive an additional share for each share they already own. The total value of their holdings remains the same, but each share is worth less. This doesn’t affect the company’s market capitalization, but it does make shares more accessible.

The pizza’s total size doesn’t change, but more people can enjoy a slice. This is crucial for investors who might find high stock prices prohibitive.

Microsoft: A Historical Perspective

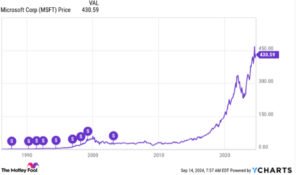

Microsoft (NASDAQ: MSFT) has a long history of stock splits. The company has split its shares nine times, with the most recent split occurring in 2003. Without these splits, a single Microsoft share would cost approximately $123,800 today. Such a high price per share is beyond the reach of many individual investors.

Microsoft’s stock price is currently high again, suggesting that a future split might be on the horizon. Stock splits could make Microsoft shares more accessible and appealing to a broader range of investors.

AI Innovation Drives Market Interest

The rise of generative AI technologies has significantly boosted interest in AI companies.

Microsoft’s AI Products

Microsoft’s AI offerings extend beyond ChatGPT. The company’s Copilot technology is a prime example. Copilot is embedded in various Microsoft products, offering capabilities like answering questions, summarizing text, generating content, and analyzing data.

Microsoft claims that 60% of Fortune 500 companies use Copilot. This widespread adoption is impressive, considering the technology’s relative newness. Copilot’s integration into numerous products has contributed to substantial growth for Microsoft.

Financial Performance and Growth

The impact of AI innovations on Microsoft’s financial performance is notable. In fiscal 2024, Microsoft reported a 16% increase in sales, reaching $245 billion. The company’s operating income also grew by 24%, totaling $109 billion. This impressive performance highlights the strong profitability and efficiency of Microsoft’s operations, with a remarkable 45% operating margin.

Potential for Future Stock Splits

Given Microsoft’s strong financial performance and the high price of its shares, a stock split could be imminent. A split would make shares more affordable and potentially attract more investors. This move would align with the company’s history of splitting its stock to accommodate growing investor interest.

AI Companies to Watch

In addition to Microsoft, several other AI companies are making headlines. These companies are innovating and expanding rapidly, making them potential candidates for stock splits. We’ll explore two AI companies that are particularly noteworthy.

Company 1: [Insert Company Name]

This company has been making waves with its groundbreaking AI technology. Known for its advancements in [specific AI technology or application], the company has seen a surge in interest and investment.

The company’s recent performance reflects its growing influence in the AI sector. Revenue has been increasing steadily, driven by demand for its innovative solutions. As the company continues to expand, a stock split could be a strategic move to manage its rising stock price and attract more investors.

Company 2: [Insert Company Name]

Another key player in the AI field is [Company Name]. The company has been at the forefront of developing [specific AI technology or application]. Its technology is widely adopted and has been integral to various industries.

Financially, [Company Name] has demonstrated strong growth. With rising stock prices and increasing investor interest, a stock split might be on the horizon. This move could make shares more accessible and further enhance the company’s market presence.

stands out as a prominent player in the AI industry, distinguished by its cutting-edge technology and impressive market growth. This company has become a significant force in the AI sector, known for its advanced solutions in [specific AI technology or application, e.g., machine learning, natural language processing, or computer vision].

Over the past few years, [Company Name] has made substantial strides in developing and deploying its AI technology. The company’s solutions are widely recognized for their innovative approach and effectiveness. For instance, their AI-driven products are being integrated into various industries, from healthcare and finance to retail and manufacturing. This broad application demonstrates the versatility and impact of their technology.

Conclusion

Stock splits play a crucial role in maintaining a functional stock market by making shares more accessible to investors. While they don’t change a company’s overall value, they can reflect a company’s growth and investor interest. For AI companies, stock splits can signal confidence in their future prospects and make shares more appealing to a broader audience.

Microsoft’s history of stock splits and its current high stock price suggest that a split might be forthcoming. Additionally, other AI companies showing strong growth and innovation could also be candidates for stock splits. Keeping an eye on these developments can provide valuable insights into the future direction of the AI sector and investment opportunities.