5 Powerful Reasons to Buy Home Depot Stock. Could Buying Home Depot Stock Today Change Your Financial Future?

History of Transformative Returns

Home Depot has made investors wealthy. Its steady growth and market dominance have driven this success. The company’s journey offers valuable lessons for investors. 5 Powerful Reasons to Buy Home Depot Stock.

A Well-Run Giant in Retail

Home Depot dominates the home improvement market. With 2,300 stores, it generates $154 billion annually. Its scale gives it a competitive edge. Products are sourced cheaper and delivered faster.

Its financial efficiency stands out. This reflects its ability to make smart financial decisions.

Why Home Depot Is Special?

1. Efficient Business Model

Home Depot turns investments into profits. Over the years, it has reinvested wisely. Sales growth compounds these returns.

2. Strong Earnings Growth

Home Depot grows earnings gradually. Its share buybacks have reduced its share count by 24% over a decade. This expand its earnings per share, which rose 211% during that time. It’s a strategy that rewards shareholders.

3. Dividend Growing

Cash profits support its growing dividend. Investors enjoy stable returns and increased stock value. Share repurchases further boost long-term gains.

Market Potential

1. Tapping Into Housing Growth

This creates opportunities for builders and renovators.

2. Expanding Into New Areas

Home Depot acquired SRS Distribution for $18.25 billion. This move opens markets in professional roofing, landscaping, and pool construction. It signals growth into untapped niches.

3. A $1 Trillion Market

With current annual sales at $154 billion, there’s room to grow. However, market cycles may impact growth.

Challenges Ahead

1. Mature Business Status

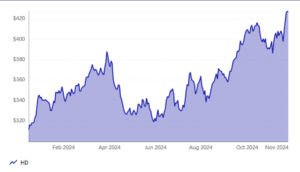

Home Depot is now a blue-chip stock. Its best growth years might be behind it. With a $420 billion market cap, growth potential is slower compared to its early years.

2. Valuation Concerns

The stock’s forward price-to-earnings (P/E) ratio is 28. While not overpriced, it’s high for modest growth expectations. The PEG ratio of 2.8 suggests limited upside potential in the near term.

What Can Investors Expect?

1. Moderate Returns

Analysts predict Home Depot’s earnings will grow by 9%-10% annually in the next three to five years.Investors can expect more profit.

2. Long-Term Potential

These returns can compound over time. While no longer a “home run,” Home Depot offers stability. It’s suitable for investors seeking steady, long-term gains.

Why Home Depot Still Matters

1. Reliable Fundamentals

Home Depot remains a strong, reliable business. Its fundamentals make it a cornerstone of diversified portfolios. It may not deliver extraordinary gains, but it ensures stability.

2. Catering to Housing Trends

The company’s focus on housing-related markets ensures relevance. Whether it’s new homes or renovations, Home Depot plays a key role.

3. Consumer Reach

Its vast network ensures proximity to most consumers. Home Depot retains a loyal customer base.

Bottom Line

1. Not a Quick-Rich Scheme

Buying Home Depot stock today won’t likely make you rich overnight. Its mature status and high valuation limit explosive growth. But for long-term wealth building, it’s a solid choice.

2. Stable Returns With Lower Risk

Home Depot is ideal for those who value reliability. Its growth may be slower, but its stability is unmatched.

3. A Thoughtful Investment

Home Depot offers steady, predictable returns. Investors should set realistic expectations. While it may not transform your finances instantly, it can build wealth steadily over time.

Should You Buy Home Depot Stock Today?

1. Consider Your Goals

Assess your financial goals before investing. Home Depot is worth considering, if stability and moderate returns appeal to you. For higher growth, explore emerging opportunities.

2. Timing the Market

Home Depot stock may be impacted by housing and economic cycles. Buying during market dips could enhance returns.

3. Diversify Your Portfolio

Don’t rely only on Home Depot. Diversification spreads risk and maximizes growth potential.

Final Thoughts

Is It Worth It?

Home Depot remains a strong, well-managed company. Its fundamentals and market position ensure long-term relevance. While its best growth years are behind it, the stock can still deliver steady returns.

Make an Informed Decision

Investors should weigh the potential returns against current valuations. Home Depot is less about dramatic growth and more about steady wealth accumulation.

Investing in Home Depot requires careful thought and evaluation. While the stock has a strong history of delivering exceptional returns, its current status as a mature business means that future performance may differ. Understanding the company’s strengths and limitations can help you make a good investment choice.

First, assess your personal financial goals. If you’re seeking high-risk, high-reward opportunities, Home Depot may not align with your objectives. Its growth is steady but unlikely to replicate the explosive returns of its earlier years. However, for those focused on stability and consistent returns, it remains a reliable choice.

Next, consider the company’s valuation. Home Depot’s forward price-to-earnings (P/E) ratio is relatively high, signaling that expectations for future growth are already baked into the stock price. This doesn’t make the stock unattractive, but that significant gains may require patience. Be prepared for slower, long-term compounding rather than quick wins.

Evaluate the broader market trends as well. Home Depot is heavily determined by the housing market and consumer spending. A growing housing shortage in the U.S. offers opportunities, but economic downturns could pose challenges. Timing your investment during market dips or economic slowdowns might allow for greater upside potential.

Lastly, diversification is key. While Home Depot is a strong challenger in the home improvement sector, relying too heavily on a single stock can increase risk.

A Safe Bet for the Long Run

If you value stability, Home Depot is a good addition to your portfolio. Just don’t expect it to replicate its past meteoric rise. It’s a solid, reliable investment for the patient investor.