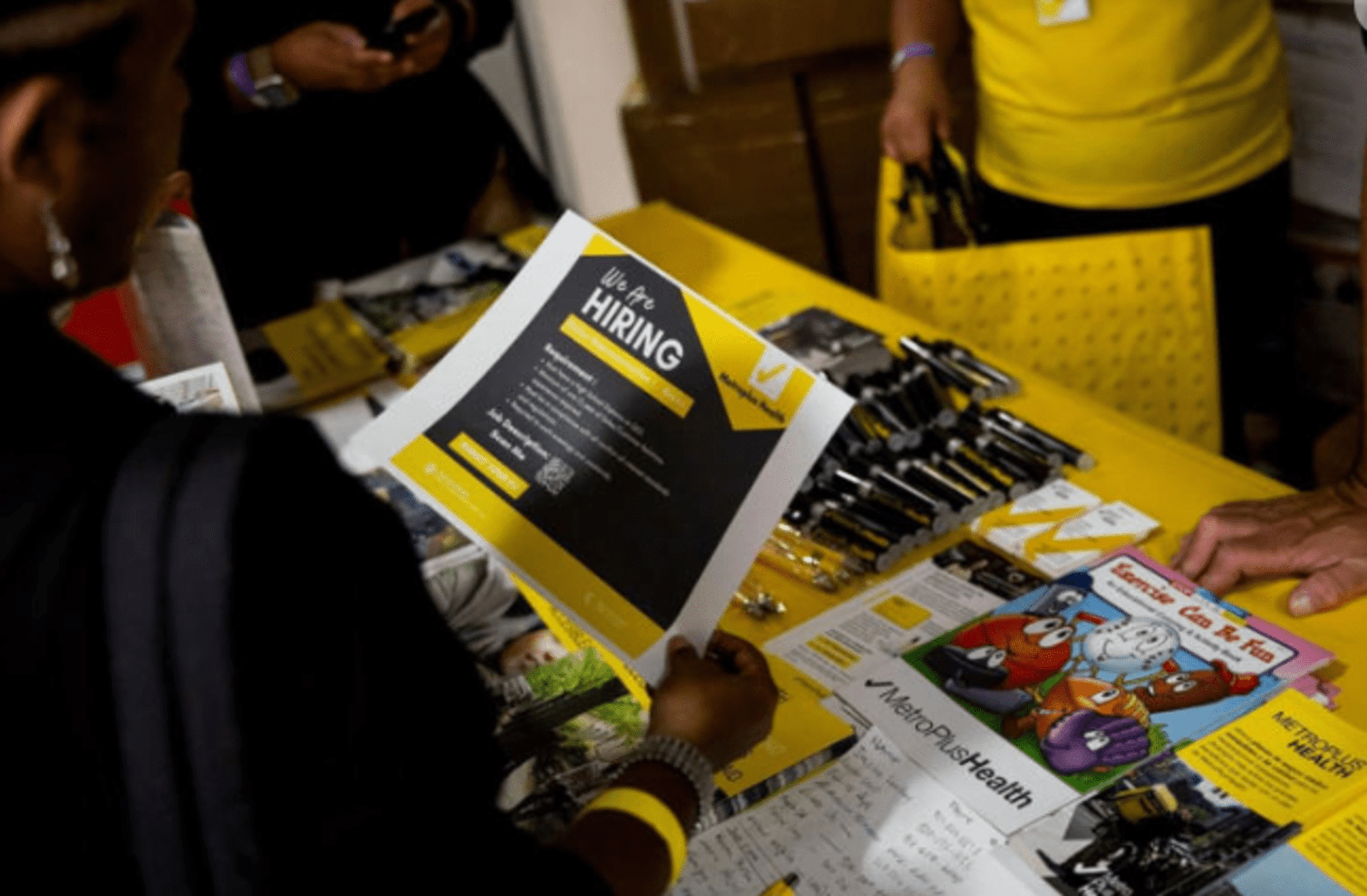

Job Growth Surge 5 Key Takeaways. U.S. Hiring Accelerated in September: Strong Job Growth Surprises Economists

The pace of hiring in the U.S. increased significantly in September. This surge comes as the unemployment rate fell to 4.1%. These figures indicate that the U.S. economy continues to gain momentum. This trend is evident especially after the Federal Reserve made its first interest-rate cut in four years. Job Growth Surge 5 Key Takeaways

Stronger Job Growth

Economists surveyed by The Wall Street Journal had expected a much lower number of new jobs. They predicted an increase of 150,000 jobs for September. The actual numbers exceeded these expectations.

The job market shows resilience. Joe Brusuelas, the chief economist at RSM U.S., noted, “The American labor market remains solid.” He emphasized that fundamental demand drives this growth. Job growth continues to thrive, and wages are on the rise.

Revised Job Figures

Revisions to previous job reports revealed good news. This upward revision highlights the strength of the labor market.

Inflation Easing

Inflationary pressures have eased over the past two years. The Fed is now more concerned about job growth rather than just controlling prices. This shift will affect their decisions regarding interest rates.

Fed’s Future Rate Cuts

The Federal Reserve is expected to cut rates again in their next meeting. The new job data will not alter this expectation. However, the strong September report might change some forecasts. It could close the door on a potential half-percentage-point rate cut.

Instead, a quarter-point cut seems more likely. The jobs market will play a crucial role in the Fed’s decisions going forward. It has been emphasized that employment data is vital for policy adjustments.

The Federal Reserve’s approach to interest rates is pivotal in shaping the U.S. economy. As economic conditions evolve, the Fed must adapt its monetary policy to foster growth while keeping inflation in check. Future rate cuts are increasingly anticipated, especially in light of recent economic data indicating robust job growth and stabilizing inflation.

When rates decrease, businesses are more likely to invest in expansion, and consumers may feel encouraged to make significant purchases, such as homes and cars. This increased spending can lead to higher demand for goods and services, further boosting economic activity.

Moreover, the Fed’s focus on employment has shifted its priorities. With the labor market showing resilience and the unemployment rate declining, the central bank is likely to prioritize job creation over inflation concerns in the near term. This shift suggests that the Fed may be more inclined to implement gradual rate cuts to support ongoing economic recovery.

If the economy shows signs of overheating or if inflation begins to rise unexpectedly, the Fed may need to reconsider its strategy. Balancing these competing factors is crucial for maintaining economic stability.

Market reactions also play a significant role in the Fed’s decision-making process. Investors closely monitor economic indicators, and their expectations can influence the central bank’s actions.

Economic Outlook

The economic outlook remains positive. More jobs mean more income for families. Increased income usually leads to higher spending.

Businesses are responding to this demand. Many are hiring more workers to meet the needs of consumers. Industries such as healthcare, technology, and hospitality have shown strong job growth.

The economic outlook for the United States remains cautiously optimistic as various indicators point toward a sustained recovery. Key factors contributing to this positive sentiment include steady job growth, improved consumer confidence, and stabilizing inflation rates. Each of these elements plays a crucial role in shaping the overall economic landscape.

Job growth has been robust, with many sectors adding positions at a pace that outstrips expectations. This increase in employment not only bolsters household income but also enhances consumer spending—an essential driver of economic activity. When individuals feel secure in their jobs, they are more likely to make significant purchases, further stimulating the economy.

Consumer confidence is another critical component of the economic outlook. As people regain trust in the economy’s stability, they tend to spend more freely. Surveys indicate a rise in consumer optimism, which bodes well for businesses across various industries. Higher consumer spending can lead to increased production, hiring, and investment, creating a virtuous cycle of growth.

The Federal Reserve’s careful management of interest rates aims to keep inflation in check while promoting economic growth. As inflationary pressures ease, consumers may find it easier to make purchases, boosting economic momentum.

However, challenges remain. Geopolitical tensions, supply chain disruptions, and labor shortages could pose risks to sustained growth. Policymakers and businesses must navigate these uncertainties to maintain stability.

In summary, the economic outlook is characterized by a blend of optimism and caution. With job growth and consumer confidence on the rise, there are strong foundations for continued recovery. Yet, vigilance is necessary to address potential challenges that could impact the trajectory of the economy.

Conclusion

The U.S. hiring landscape in September exceeded expectations. With job growth strong and the unemployment rate down, the economic outlook is bright. Future interest rate decisions will be influenced by the ongoing strength of the labor market.

As the economy continues to expand, maintaining this momentum will be essential. The data suggests that the U.S. labor market is well-positioned for continued growth. This is a crucial moment for workers and businesses alike.